Recent Articles

Your Path to Affordable Homeownership: Discover FHA Mortgage Solutions in Margate with Osprey Mortgage Lendings

Buying a home should be an exciting milestone, not a stressful financial challenge. At Osprey Mortgage Lendings, we help make that dream achievable through our FHA mortgage services in Margate. Designed for first-time buyers and families who want flexible, affordable financing, an FHA mortgage can open the door to homeownership with less financial strain and greater confidence.

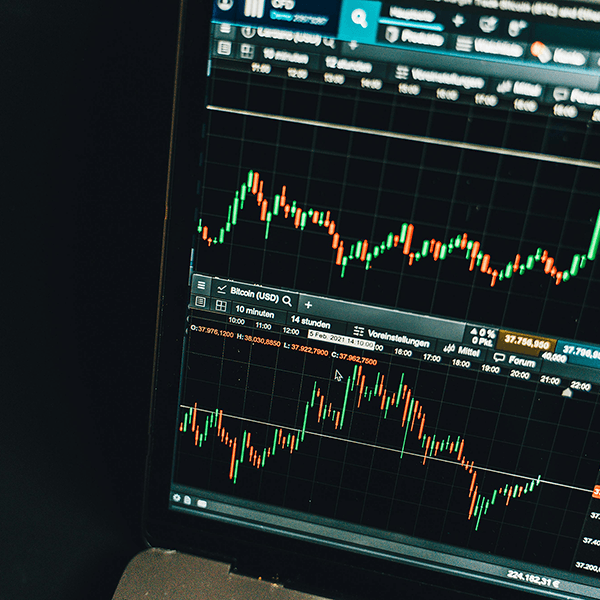

Mortgage Rates Hold Near Yearly Lows as Market Awaits Next Data

The average 30-year fixed mortgage rate is hovering near 3-year lows as bond markets hold steady amid limited economic data. Learn why rates remain low and what could move them next.

Gen Z and the Dream of Homeownership: Adapting to a Challenging Market

A new Realtor.com survey reveals that 1 in 5 Gen Z adults say housing affordability is their top life concern. Learn how young buyers are adapting, saving, and staying determined to achieve homeownership.

Building Your First Home Dream in Margate with FHA Mortgages

At Osprey Mortgage Lending, we meet many people in Margate who are excited about homeownership but feel nervous about the financial steps it takes to get there. What often surprises our clients is how an FHA mortgage is not just a loan program but a stepping stone to stability, community, and opportunity. Instead of looking at it as a simple financial product, we see FHA mortgages as a bridge that connects hardworking families in Margate to homes where futures are built.

Unlocking New Possibilities: Refinancing Your Mortgage in Pompano Beach with Osprey Mortgage Lending

When most people think about refinancing, they often picture it as a simple way to lower monthly payments. While that’s one advantage, at Osprey Mortgage Lending, we know refinancing can mean so much more—especially here in Pompano Beach, where financial goals often blend with lifestyle choices, property growth, and long-term planning.

Unlocking the Value of VA Mortgages in Coral Springs: How We Serve Those Who Served

When it comes to buying a home in Coral Springs, every journey is unique. But for veterans, active-duty service members, and their families, the path to homeownership should feel less like a maze and more like a welcome home. That’s where VA mortgages step in—and at Osprey Mortgage Lending, we’re proud to help our local heroes take advantage of the benefits they’ve earned.

Mortgage Rates Tick Up Slightly as Bonds Weaken and MBS Underperform

On October 9, 2025, the average 30-year fixed mortgage rate edged slightly higher to 6.38% after a weaker 30-year Treasury auction and mild MBS underperformance. Rates remain stable within a narrow range as the government shutdown continues.

Mortgage Rates Holds Steady After Weak Jobs Report

On October 1, 2025, the average 30-year fixed mortgage rate held at 6.37% after weak private payroll data. Bigger shifts may follow when the delayed government jobs report is released.

We Help You Every Step of the Way

Buying a home in Coral Springs is more than a financial decision—it’s a lifestyle choice. With tree-lined neighborhoods, excellent schools, and a vibrant community, it’s no surprise that families and professionals alike are drawn to this South Florida city. But before you can unlock the door to your new home, the mortgage process often feels like the biggest hurdle. At Osprey Mortgage Lending, we’ve built our approach around making that journey simple, personal, and stress-free.